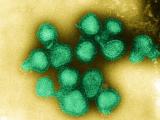

Intensive federal deliberations are under way on whether to stockpile a vaccine against the H7N9 flu virus that emerged this spring in China, similar to the government's response to the H5N1 avian flu threat, health officials said today.

In the meantime, vaccine companies are getting ready to produce enough vaccine for clinical trials, which are slated to begin in August, according to an update presented before the National Vaccine Advisory Committee (NVAC), an outside group that assists the US Department of Health and Human Services (HHS). The meeting was broadcast live on the Web.

Robin Robinson, PhD, director of the HHS' Biomedical Advanced Research and Development Authority (BARDA) told the group that over the past 4 years federal health officials have used an assessment tool to weigh the risks of novel flu viruses and consider any steps to take with vaccine and other preparedness activities.

He said the risk weighting for H7N9 virus and the 2009 H1N1 virus bear some resemblances, with an uncanny similarity in timing. "It's been 4 years and 1 week since I was here to talk about possible pandemic vaccine efforts [for the 2009 pandemic H1N1 virus]," Robinson said.

When the variant H3N2 virus popped up at state and county fairs in the United States last summer, federal officials used the same risk-assessment tool and decided to go only as far as making enough vaccine for clinical trials, he said. However, if the H7N9 virus evolves to support sustained human-to-human transmission, the government would consider a large-scale vaccine campaign.

In stockpiling discussions, federal officials are weighing factors such as whom to vaccinate, what vaccine platforms to include, production capacity, timing, and cost, Robinson said. A decision on stockpiling could come this summer, he added.

Vaccine development details

So far nine different H7N9 seed strains have been developed for vaccine production, and most of them were made with reverse genetics. However, Robinson said some classic reassortants are starting to emerge.

Reminiscent of the 2009 H1N1 vaccine, health officials are seeing disappointing yields of antigen with the vaccine seeds used with traditional egg-based production methods, Robinson said. Lower-than-expected antigen yield was one factor that hampered the H1N1 vaccine in its early stages of production. However, he said one change from 2009 is that scientists can recognize that issue up front. Officials saw antigen yield increase in 2009 as production of the pandemic vaccine hit its stride.

A major difference between 2009 and now is that the H7N9 trials will include two new platforms—cell based and recombinant. "We have more tools in our toolbox," he said.

In October 2012 a 3-year review of existing influenza vaccines called out gaps in protection, especially in older people. Its researchers said the newest vaccine technology targets the same part of the flu virus—the hemagglutinin (HA) head—as traditional vaccines and aren't likely to yield substantial efficacy improvements.

The group, from the University of Minnesota's Center for Infectious Disease Research and Policy, publisher of CIDRAP News concluded that new approaches are needed, such as vaccines that target the HA stalk, and that major national and global efforts are required to overcome significant challenges in producing a game-changing flu vaccine.

Progress on the recombinant vaccines is running a little ahead of the traditional vaccines, with better antigen yields so far, Robinson said, predicting that the first vaccine lots will be released in July, with the first clinical trials to launch in August. "That may sound familiar, because that's when we started testing the H1N1 vaccine," Robinson said.

BARDA has been supporting an H7N1 vaccine candidate made by GlaxoSmithKline, and trials of that vaccine will launch in early July, he said. Given that the vaccine is a "cousin" of the H7N9 vaccine, those trials are likely to produce interesting findings shortly in advance of the H7N9 results. The H7N1 virus is one of a handful of flu strains considered to have pandemic potential.

The Food and Drug Administration (FDA) has already started work on the potency assay reagents that will be used to assess the candidate H7N9 vaccines, Robinson said. He added that at least two alternate potency assays are being assessed. A federal countermeasure assessment and a White House review of the 2009 H1N1 vaccine campaign both suggested that new vaccine potency assays might be one way to shorten pandemic vaccine production timelines.

H7N9 challenges ahead

Looking ahead to the H7N9 trials, federal officials and researchers will have some daunting challenges. "Historically, H7 vaccines haven't provided a very rosy picture for us," Robinson said. "We have our work cut out for us."

Earlier trials of inactivated subunit H7 vaccines with and without adjuvant haven't shown a strong immune response, he said. "That is alarming."

Robinson said live-attenuated influenza vaccine (LAIV) trials with H7 strains have shown modest immunity, for what can actually be measured. More recently, studies have hinted that priming with LAIV H7 vaccine followed by vaccination with inactivated vaccine may produce a robust response, he told the group.

Last month, CIDRAP Director Michael T. Osterholm, PhD, MPH, and colleagues said in a Journal of the American Medical Association (JAMA) commentary that if the H7N9 evolves into a pandemic strain, the world is unlikely to make enough of the vaccine in time to dampen the impact. Besides the limited effectiveness of H7 vaccines tested so far, the global public health community remains unprepared, they wrote, despite added vaccination production capacity.

The group projected that at the 90-microgram (mcg) dose used for the H5N1 vaccine, the global capacity for H7N9 vaccine would be 757 million doses, less than 15% of the global need.

Robinson said researchers don't know what dosage is needed, but given the lack of population immunity to H7 strains, the amount of antigen in a dose of unadjuvanted vaccine might require as much as 90 mcg, as with the H5N1 version. He predicted that two doses of H7N9 vaccine would be needed. With that estimate, it would take 18 months to provide enough vaccine for everyone, with the cost likely to be prohibitive, he said.

As federal officials weigh different H7N9 vaccine scenarios, one decision they have made is that its production should not delay seasonal flu vaccine manufacturing, he said.

The combination of factors involves may increase the possibility that a dose-sparing adjuvanted vaccine would be needed in an H7N9 immunization campaign, Robinson said. Unlike in many other parts of the world, adjuvants haven't been used in US flu vaccines, and their inclusion in a pandemic vaccine would create challenges in pitching it to a public that is unfamiliar with the vaccine boosters.

NVAC members asked federal health officials about H7N9 vaccine efforts under way in China. During the 2009 H1N1 pandemic, China was the first country to bring a vaccine to market. Robinson said several different companies in China are developing H7N9 vaccines. "They are probably at the same point we are," he said.

See also:

NVAC meeting materials

May 10 CIDRAP News story "Experts offer dim view of potential vaccine response to H7N9"

Oct 15, 2012, CIDRAP News story "Report: Complacency, misperception stymie quest for better flu vaccines"